Many shoppers miss significant savings by paying full price. The problem isn’t lack of discounts–it’s not knowing where to find transparent, accessible savings without membership fees or seasonal waiting.

Snaplii provides 5-12% instant cashback on 500+ retailers with immediate digital delivery. These best gift card discounts work year-round, requiring no minimum purchases or hidden fees.

This guide reveals current gift card deals in 2026, showing where to find them and how to save money with gift cards strategically.

Where to Find the Best Gift Card Deals Right Now

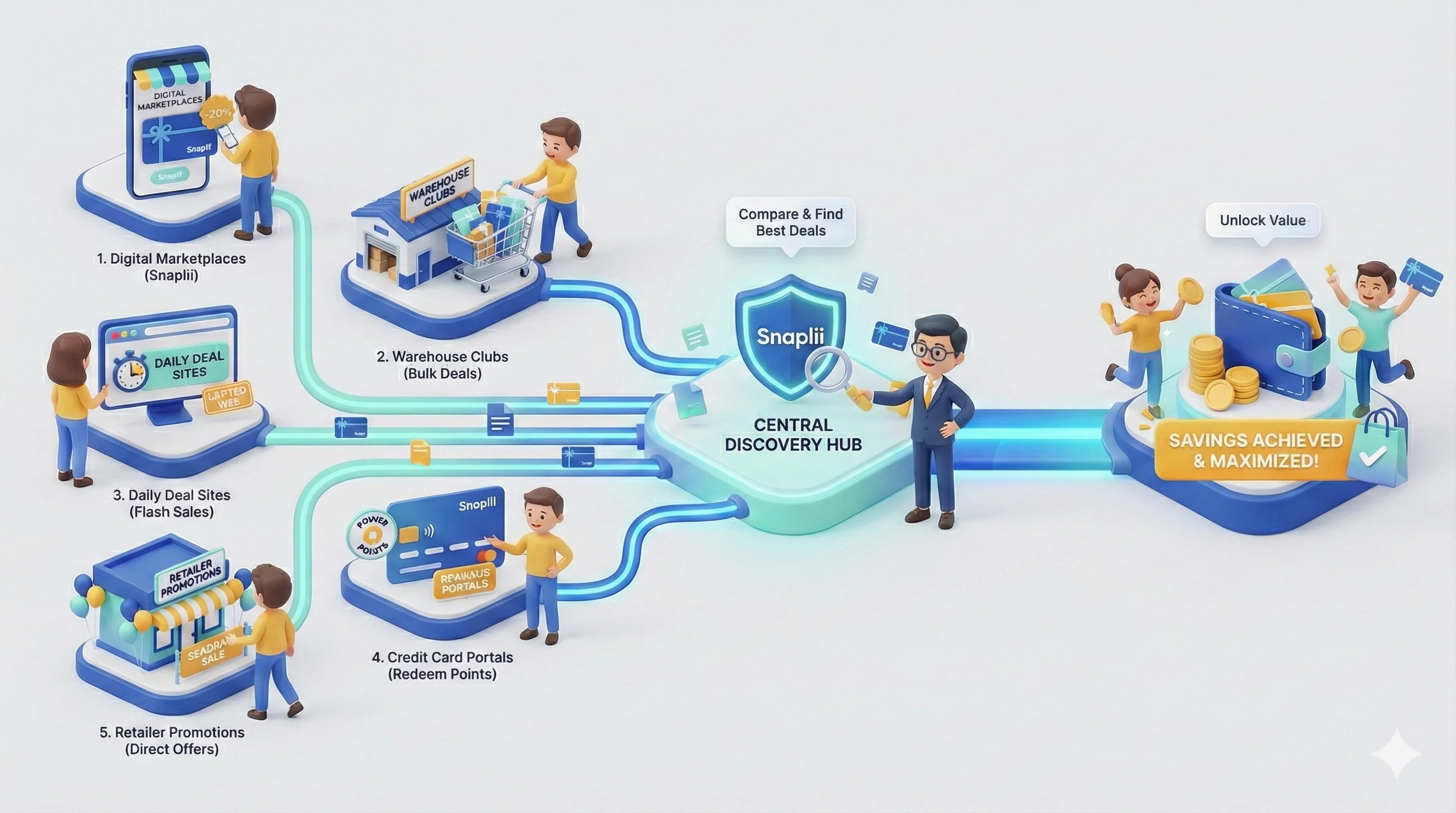

Three main channels offer gift card deals with different value propositions.

| Channel | Savings Rate | Availability | Requirements | Best For |

|---|---|---|---|---|

| Instant Cashback Platforms | 5-12% | Year-round | None | Daily spending |

| Warehouse Clubs | 10-20% | Seasonal | Membership ($60-120/yr) | Bulk buyers |

| Bank Promotions | 3-5% | Limited time | Specific credit card | Existing cardholders |

Instant cashback platforms deliver superior value for most shoppers: no waiting for promotions, no minimum purchase requirements, no annual fees.

The key advantage is transparency and immediacy. You see exact percentages before purchase. Cashback credits within seconds, not 6-12 weeks.

Warehouse clubs sound attractive at 10-20% off, but a $60 membership requires $600 in purchases just to break even at 10% discount. Compare: 8% instant cashback with zero fees saves $80 on $1,000 with no upfront cost.

Snaplii provides 500+ retailers with instant digital delivery. Earned Snaplii Cash never expires, functioning as permanent savings you can use anytime.

Current Gift Card Cashback Rates by Category (2026)

Different categories offer varying cashback rates. Understanding these helps prioritize which gift cards deliver the most value.

| Category | Current Cashback | Monthly Spending Example | Annual Savings |

|---|---|---|---|

| Groceries & Supermarkets | 4-5% | $400 | $240 |

| Gas Stations | 5-10% | $150 | $144 |

| Restaurants & Dining | Up to 10% | $250 | $270 |

| Coffee Shops | 5-12% | $100 | $120 |

| Entertainment | 10-15% | $80 | $120 |

| Travel & Hotels | 5-15% | Varies | High per transaction |

| Fashion & Apparel | Up to 10% | $100 | $120 |

| Beauty & Personal Care | 5-10% | $60 | $54 |

Prioritize purchase frequency over maximum percentage. High-frequency categories like groceries generate more annual savings than high-percentage deals on quarterly visits.

The math: 5% cashback on $400 monthly groceries = $240 annually. Meanwhile, 15% on $50 quarterly entertainment = only $30 annually. Lower percentage on higher frequency delivers 8x more savings.

For maximum returns, identify your top three categories. Groceries and gas generate $384 annually. Adding dining brings total to $654–simply by changing payment method, not reducing spending.

How Much Can You Save with Current Gift Card Deals

Real-world savings vary by household type. Three scenarios illustrate realistic annual returns when you save money with gift cards.

- Family of 4: Groceries ($600/mo × 5%) + Gas ($200/mo × 8%) + Dining ($150/mo × 9%) = $714 annually

- Young professional: Dining ($300/mo × 9%) + Coffee ($120/mo × 10%) + Entertainment ($100/mo × 12%) = $612 annually

- Retiree couple: Groceries ($350/mo × 5%) + Gas ($100/mo × 8%) + Travel ($2,000/yr × 12%) = $546 annually

These calculations assume you purchase gift cards before shopping at retailers you already frequent. No behavior change required–just switching payment method generates $550-700 annually.

Compare alternatives: Coupon clipping generates $200-300 annually but requires 2-3 hours weekly (time cost: $1,560-2,340 annually at $15/hour). Seasonal warehouse sales offer 15-20% discounts but require waiting months.

Instant cashback provides consistent savings whenever you shop. The critical insight: regular 5-8% savings on frequent purchases accumulate faster than sporadic 20% discounts.

How to Identify Legitimate Gift Card Deals

Four characteristics separate legitimate offers from problematic promotions.

- Transparent rates: Legitimate platforms display exact cashback percentages before purchase–”5% on groceries” or “10% on dining.” Vague promises like “up to 90% savings” signal potential problems.

- Immediate delivery: Digital gift cards should arrive within seconds. Platforms requiring “7-10 business days” are either poorly operated or problematic. Legitimate platforms deliver both gift card and cashback simultaneously.

- No hidden fees: Zero activation fees, monthly charges, or expiration penalties. A 10% discount with $5 activation fee on a $50 card eliminates your savings.

- Verified partnerships: Platforms stating 500+ specific, named retailers provide accountability. Vague claims about “thousands of brands” suggest partnerships may not exist.

Red flags to avoid: Excessive personal information requests, artificial urgency timers, social sharing requirements, discounts >50%, missing customer service contacts.

Snaplii demonstrates credibility through 300,000+ users, 4.9-star rating, and transparent real-time tracking. Snaplii Cash appears immediately with no expiration. Terms are clearly accessible before purchase.

Best Gift Card Deals by Category This Month

2026 presents specific opportunities based on seasonal patterns and current rates.

- Entertainment (10-15% cashback): Post-holiday spending typically spikes as people use gift money. Movie theaters, streaming services, concert venues. Purchase now for Q1 entertainment.

- Dining (up to 10% cashback): New Year restaurant promotions overlap with year-round rates. Fine dining, delivery services, coffee shops benefit. Many restaurants run early-year promotions–buy cards now for winter dining.

- Travel (5-15% cashback): Early booking window for summer travel opens now. Hotels and airlines release summer inventory in early 2026. Purchase cards at 12-15% cashback now for summer bookings.

- Consistent value categories: Groceries (4-5%) deliver highest absolute annual savings despite modest percentages. Weekly shopping on $400-600 monthly generates $240-360 annually. Gas (5-10%) provides reliable returns on commuting.

Match categories to your profile: Families maximize value through groceries + gas ($384+ annually). Young professionals benefit from dining + entertainment ($468+ annually). Travel planners prioritize travel + fashion when preparing trips.

FAQ About Gift Card Deals

Can I combine gift card deals with store sales?

Yes. Purchase cards through Snaplii for 5-12% cashback, then use during retailer sales. Example: 9% cashback on fashion card + 30% store sale = compound savings. These are separate transactions–earn cashback buying the card, benefit from sale when spending it.

How quickly do I receive gift cards and cashback?

Digital cards deliver instantly to your wallet within seconds. Cashback credits simultaneously with no waiting. Traditional promotions require 6-12 weeks. Use both immediately–the card for purchases, cashback for future cards.

Do gift card cashback deals expire?

Snaplii’s rates are year-round with no expiration on rates or earned Snaplii Cash. Unlike seasonal promotions ending after holidays, access these deals daily. Accumulated cash never expires–use immediately or save indefinitely.

Are higher percentage deals always better?

Not necessarily. 5% on weekly groceries ($400/mo = $240/yr) beats 15% on stores visited once ($100 = $15 total). Match deals to spending patterns. Calculate annual value: monthly spending × cashback % × 12. Frequency matters more than maximum percentage.

Final Words

Finding the best gift card discounts doesn’t require hunting seasonal promotions or paying membership fees. The most effective approach combines transparency, consistency, and matching deals to your spending patterns.

Instant cashback platforms eliminate traditional tradeoffs between discount size and accessibility. You get 5-12% savings year-round on 500+ retailers without waiting, minimum purchases, or annual fees.

Real value emerges when you align purchases with high-frequency categories. Families save $714 annually, young professionals $612, retirees $546–all by purchasing gift cards before shopping at familiar retailers.

Start this week: identify your top three spending categories, calculate typical monthly spending in each, then purchase next month’s gift cards through Snaplii. Within 30 days, you’ll have concrete data on your savings rate.

The opportunity exists now, not next holiday season. Your first step determines whether you continue paying full price or begin saving on every purchase.