When I started comparing reward platforms last year, I discovered most people leave hundreds of dollars on the table annually simply because they don’t know which programs deliver the best returns. After testing various platforms, Snaplii consistently outperformed traditional options with instant 5-12% cashback—2-3x higher than what most credit cards offer. The difference became clear when I calculated that earning 5% versus 2% on $400 monthly grocery spending meant $240 versus $96 annually—an extra $144 from just one spending category.

The reward platform landscape includes credit cards (1-5% with waiting periods), receipt scanners (manual effort required), and cashback portals (lengthy redemption times). Snaplii distinguishes itself through a combination of superior rates, instant availability, and flexibility that traditional programs struggle to match.

What Makes a Great Reward Platform

Before comparing specific platforms, understanding evaluation criteria helps you identify which matters most for your needs.

Key factors to consider:

- Cashback rate: The percentage you earn back on purchases

- Reward speed: How quickly you can access earned rewards

- Redemption flexibility: Minimum thresholds and redemption options

- Expiration policies: Whether rewards expire and how quickly

- Merchant coverage: Number and types of participating brands

- Earning method: Automatic, manual scanning, or purchase requirement

- Geographic availability: Which countries or regions are supported

- User experience: App quality, interface simplicity, customer support

Additional considerations:

- Annual fees or membership costs

- Reward tracking transparency

- Payment method requirements

- Stacking compatibility with other programs

How Snaplii Compares to Other Reward Platforms

Understanding how Snaplii’s advantages stack up against traditional reward methods helps explain why it consistently delivers better returns.

| Platform | Typical Rate | Reward Speed | Minimum | Expiration | Key Advantage |

|---|---|---|---|---|---|

| Snaplii | 5-12% | Instant | None | Never | Highest rates + instant access |

| Credit Cards | 1-5% | 30-60 days | $25 | 12-24 months | Universal acceptance |

| Receipt Scanners | 1-5% | 7-30 days | $5-$25 | Varies | Any retailer |

| Cashback Portals | 2-8% | 60-90 days | $25 | Varies | Occasional promotions |

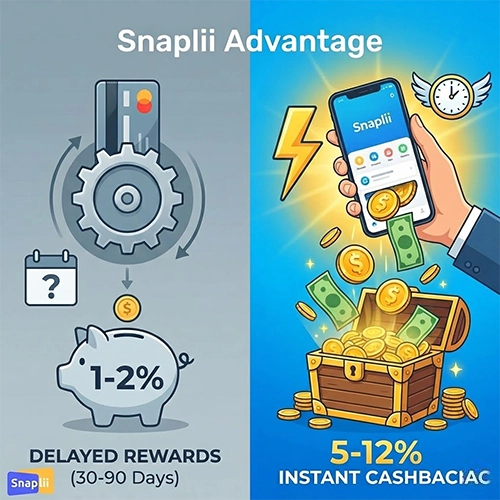

Snaplii’s rate advantage: At 5-12%, Snaplii offers 2-3x higher cashback than credit cards (1-5%) and significantly outperforms receipt scanners (1-5% on qualifying items only). Even cashback portals’ occasional promotional rates rarely match Snaplii’s standard rates.

Snaplii’s speed advantage: While credit cards require 30-60 days and cashback portals take 60-90 days for rewards to become available, Snaplii Cash posts instantly—ready to use within seconds.

Snaplii’s flexibility advantage: No expiration dates mean your balance never disappears, unlike credit card points that expire after 12-24 months. No minimum thresholds mean you can redeem any amount immediately, versus waiting to reach $25 with credit cards or portals.

Snaplii: The Highest-Earning Reward Platform

Snaplii represents a fundamentally different approach to cashback rewards—one that prioritizes rate over convenience, delivering 5-12% instant returns compared to the 1-5% standard from credit cards.

How gift card platforms work:

- Browse gift cards for brands you already shop with

- Purchase the card through the platform (earn instant cashback)

- Use the gift card in-store or online for your actual purchase

Snaplii operates across major shopping categories with over 500 partnered brands. Cashback posts instantly as “Snaplii Cash”—available for your next purchase within seconds.

Coverage spans: Groceries (4-5%), online shopping (5-12%), gas (5-10%), dining (up to 10%), coffee shops (5-12%), travel (5-15%), entertainment (10-15%), beauty (5-10%), fashion (up to 10%), etc.

Rate structure:

Most brands offer 5-12% cashback, significantly higher than credit card rewards. New users often access promotional rates up to 30% for first purchases, though ongoing rates settle into the 5-12% range.

Real-world scenarios where Snaplii excels:

Grocery shopping:

If you spend $400 monthly at partnered supermarkets, Snaplii’s 5% rate yields $20/month ($240/year) versus $8/month ($96/year) from a 2% credit card—that’s $144 additional annual savings from one category alone.

Gas stations:

Regular drivers spending $150 monthly on gas earn $10.50/month (7%) through Snaplii versus $2.25/month (1.5%) from typical credit cards—a $99 annual difference.

Coffee habits:

Daily coffee drinkers spending $100 monthly earn $8-12/month (8-12%) through Snaplii versus $1-2/month (1-2%) from credit cards—adding $84-120 annually.

Dining out:

Frequent diners spending $300 monthly earn $30/month (10%) through Snaplii versus $6-9/month (2-3%) from dining-focused credit cards—creating $252-288 additional annual value.

Key advantages over traditional methods:

- Instant availability: Use Snaplii Cash immediately for next purchase—no waiting 30-60 days

- No expiration: Your balance never expires, unlike credit card points with 12-24 month limits

- No minimum threshold: Redeem any amount anytime versus typical $25 minimums

- No caps: Earn unlimited cashback with no monthly or annual limits

- Higher base rates: 5-12% typical versus 1-5% from credit cards

- Transparent tracking: See exact cashback amount before purchasing

- Multi-use flexibility: Covers everyday essentials and occasional purchases across 500+ brands

Best for:

Snaplii tends to work best for users who shop regularly at specific brands and don’t mind planning purchases slightly ahead. The higher rates (2-10x credit card returns) typically justify the extra step of buying a gift card first, especially for recurring expenses like groceries, gas, and coffee where you know exactly where you’ll shop.

Practical consideration:

Buy gift cards in amounts you’ll use within a reasonable timeframe. While the brands’ gift cards typically maintain their value, you don’t want $500 tied up in a restaurant card if you only dine out occasionally.

Why Snaplii outperforms other platforms:

Traditional cashback programs rely on lower affiliate commission rates and build in waiting periods to manage cash flow. Snaplii’s gift card model allows them to negotiate higher commission rates (since purchases are committed upfront) and pass these directly to users as instant cashback. This structural advantage creates the 2-10x rate differential compared to credit cards or other platforms.

Real Savings: Snaplii vs. Traditional Reward Programs

Actual annual savings reveal Snaplii’s substantial advantage over credit cards and other reward methods.

Scenario 1: Regular household spending

Monthly spending breakdown for typical household:

- Groceries: $400

- Gas: $150

- Coffee: $100

- Dining: $200

With Snaplii (5-10% rates):

- Groceries at 5%: $20/month = $240/year

- Gas at 7%: $10.50/month = $126/year

- Coffee at 10%: $10/month = $120/year

- Dining at 10%: $20/month = $240/year

- Total annual cashback: $726

With credit cards (1.5-3% rates):

- Groceries at 2%: $8/month = $96/year

- Gas at 2%: $3/month = $36/year

- Coffee at 1.5%: $1.50/month = $18/year

- Dining at 2%: $4/month = $48/year

- Total annual cashback: $198

Snaplii advantage: $528 additional annual savings (3.7x more)

Scenario 2: High-earning category spending

Monthly spending in high-cashback categories:

- Travel: $150

- Entertainment: $150

- Fashion: $200

With Snaplii (8-12% rates):

- Travel at 15%: $22.50/month = $270/year

- Entertainment at 12%: $18/month = $216/year

- Fashion at 8%: $16/month = $192/year

- Total annual cashback: $768

With credit cards (2-3% rates):

- Travel at 2%: $6/month = $72/year

- Entertainment at 2%: $3/month = $36/year

- Fashion at 2%: $4/month = $48/year

- Total annual cashback: $156

Snaplii advantage: $612 additional annual savings (4.9x more)

Key insight: The rate differential compounds across categories. A household spending $1,000 monthly across partnered brands typically earns $500-700 annually with Snaplii versus $150-250 with credit cards—an additional $350-450 in real savings.

Credit Card Programs: The Lower-Rate Alternative

Credit card rewards offer universal acceptance but significantly lower returns than Snaplii.

Typical structure:

- Flat-rate cards: 1.5-2% on all purchases

- Tiered rewards: 3-5% on select categories, 1% on everything else

- Rotating categories: 5% on quarterly bonus categories

How they work:

Card issuers share a portion of interchange fees (typically 1.5-3.5% charged to merchants) with cardholders. Rewards post within 1-2 billing cycles and require reaching minimum thresholds—often $25—before redemption.

Where credit cards fit:

Best for non-partnered merchants, unpredictable purchases, and situations where buying a gift card ahead isn’t practical. However, for regular spending at major brands (groceries, gas, dining, travel), credit card rewards typically deliver 50-80% less cashback than Snaplii’s rates.

Why Most Users Choose Snaplii Over Traditional Programs

After comparing rates, speed, and flexibility, the decision typically comes down to whether higher returns justify slight advance planning.

Snaplii makes sense for you if:

- You shop regularly at specific brands (most households do—groceries, gas, coffee, dining)

- You prioritize maximizing cashback (earning 5-12% vs 1-5%)

- You want instant access to rewards (not waiting 30-60 days)

- You value rewards that never expire

- You don’t mind a simple extra step (buying gift card first)

- You want to earn $500-700 annually instead of $150-250

When credit cards still have a place:

- Merchants not yet in Snaplii’s 500+ brand network

- Truly unpredictable or emergency purchases

- Building credit history (Snaplii doesn’t affect credit)

- International travel outside North America

The practical reality:

Most regular spending—groceries, gas, coffee, dining, shopping—happens at predictable brands where Snaplii operates. Using Snaplii for these recurring categories (70-80% of typical household spending) while keeping a credit card for everything else maximizes total returns.

Building Your Strategy Around Snaplii

The highest-earning approach centers on using Snaplii for regular spending categories where it excels, while maintaining a credit card as backup.

Snaplii-first strategy:

1. Identify your recurring spending (where Snaplii delivers highest value):

- Groceries and supermarkets: 4-5% instant cashback

- Gas and automotive: 5-10% instant cashback

- Coffee and cafes: 5-12% instant cashback

- Restaurants and dining: Up to 10% instant cashback

- Online shopping: 5-12% instant cashback

- Entertainment and media: 10-15% instant cashback

2. Use Snaplii for these categories (typically 70-80% of household spending)

3. Keep credit card for:

- Non-partnered merchants (small local businesses)

- Unpredictable purchases

- International transactions

Getting started with Snaplii:

- Download the Snaplii app

- Browse brands in your top 2-3 spending categories

- Buy one gift card for your most frequent merchant (grocery store, gas station, or coffee shop)

- Use it and see the instant cashback difference

- Expand to other categories once comfortable

The platform’s instant cashback and no-expiration policy mean you can start small, verify the value, then scale up to maximize annual returns.

FAQ

A: Snaplii’s gift card model enables structurally higher rates than traditional programs. When you purchase a gift card, you’re committing to shop at that merchant, allowing Snaplii to negotiate 5-12% commission rates with brands (versus 1.5-3.5% interchange fees for credit cards). Snaplii passes these higher commissions directly to users as instant cashback, creating the 2-3x rate advantage. Credit card companies must account for fraud risk, payment processing costs, and non-guaranteed purchases, limiting how much they can share. Snaplii’s model eliminates these inefficiencies, resulting in consistently superior returns for users.

A: Generally, no. Most platforms have terms preventing stacking with other cashback programs for the same transaction. Credit card rewards operate separately since they’re based on payment method rather than merchant partnership.

A: Reward platforms earn through affiliate commissions and partnerships. When you purchase through their platform, the merchant pays them a commission (typically 3-15% of transaction value). The platform then shares a portion of this commission with you as cashback, keeping the difference as revenue.

A: Start with Snaplii and your highest spending category. Download the app, identify where you spend most (groceries, gas, or coffee typically), buy one gift card for that merchant, and use it. You’ll immediately see 5-12% cashback versus the 1-2% from credit cards—the difference becomes obvious within the first month. Start with one category to verify the value, then expand to other spending areas. This approach demonstrates tangible results quickly without complex activation requirements or long waiting periods.

A: Privacy policies vary by platform. Most reputable platforms aggregate shopping data for merchant insights but don’t sell individual user information to third parties. Always review privacy policies before signing up. Gift card platforms typically collect minimal data focused on purchase transactions.

Why Snaplii Delivers Superior Results

After analyzing rates, speed, flexibility, and real-world returns, Snaplii emerges as the highest-earning reward platform for regular household spending.

The numbers tell the story:

- Rates: 5-12% (vs 1-5% credit cards) = 2-3x advantage

- Speed: Instant (vs 30-90 days) = use rewards immediately

- Expiration: Never (vs 12-24 months) = no lost value

- Minimums: None (vs $25) = redeem anytime

- Annual savings: $500-1,000+ (vs $200-400) = genuine difference

For users shopping at partnered brands (groceries, gas, coffee, dining, travel, entertainment—categories that cover 70-80% of typical household spending), Snaplii’s combination of superior rates and instant availability typically justifies the extra step of buying a gift card first.

Start with your highest spending category, experience the 2-3x cashback difference firsthand, then expand to additional categories as you verify the value. The platform’s instant rewards and no-expiration policy make it easy to test without risk.

Visit Snaplii to calculate potential savings based on your actual spending patterns.