When I first discovered I could earn money just by shopping normally, I was skeptical. How do these cashback programs actually work? After testing various credit cards and apps over the past year, I’ve learned that understanding the mechanics behind cashback can significantly impact your monthly savings—sometimes adding up to hundreds of dollars annually.

How Credit Card Cashback Works

Credit card cashback operates through a simple revenue-sharing model. When you swipe your card, the merchant pays an interchange fee (typically 1.5-3.5% of the transaction) to your card issuer. Credit card companies share a portion of this fee with you as cashback rewards.

Common credit card reward structures include:

- Flat-rate cards: Earn the same percentage (typically 1.5-2%) on all purchases

- Tiered rewards: Higher percentages for specific categories (e.g., 3% gas, 2% groceries, 1% everything else)

- Rotating categories: Bonus rates that change quarterly and require activation

Typical redemption process:

- Cashback posts to your account within 1-2 billing cycles

- Accumulate rewards until you reach the minimum threshold (often $25)

- Redeem as statement credit, direct deposit, or sometimes gift cards

How Cashback Apps Work

Cashback apps use a different business model than credit cards. These platforms partner with retailers and receive affiliate commissions when users make purchases. They share these commissions with users as cashback rewards.

Common app types and how they work:

- Browser extensions: Track online shopping and automatically apply rewards

- Receipt-scanning apps: Require photographing receipts after shopping

- Cashback portals: Redirect you through their links before you shop online

- Gift card platforms: Offer instant cashback when purchasing digital gift cards

Snaplii takes the gift card approach, which eliminates tracking complexity. Instead of monitoring purchases or scanning receipts, you simply buy gift cards for brands you already shop with and receive instant cashback when you complete the purchase.

How Snaplii Delivers Instant Cashback

Snaplii operates as a gift card platform with over 500 partnered brands across retail, dining, gas, and entertainment. When you purchase a gift card through Snaplii, you receive immediate cashback called “Snaplii Cash”—there’s no waiting period or minimum threshold to start using your rewards.

How it works in 3 simple steps:

- Browse and select a gift card for a brand you plan to shop at

- Purchase the card through the Snaplii app (earn instant cashback)

- Use the gift card in-store or online for your actual purchase

Example scenario:

Say you plan to spend $100 at a grocery store:

- Buy a $100 gift card through Snaplii → Earn $5 (5% cashback) instantly

- Use that gift card for groceries → Scan barcode in-store or enter code online

- Your Snaplii Cash accumulates → Available to offset future gift card purchases

Categories covered:

- Groceries and supermarkets

- Online shopping and e-commerce

- Gas stations and automotive services

- Restaurants and fast food

- Coffee shops

- Travel and transportation services

- Entertainment and media

- Beauty and personal care

- Fashion and apparel

Cashback rates by category:

- Everyday essentials: 5-12% (depending on brand)

- New user promotions: Up to 30%

- No maximum earning limit

Key advantages over traditional methods:

- Instant availability: Use Snaplii Cash immediately for next purchase

- No expiration: Your balance never expires

- No minimum threshold: Redeem any amount, anytime

- No waiting period: Rewards post within seconds, not weeks

Choosing the Right Cashback Method for You

Different cashback methods serve different needs. Understanding when each approach works best helps you maximize savings without overcomplicating your routine.

Credit cards work best when:

- You want universal acceptance at any merchant

- You’re building credit history

- You prefer simplicity with automatic rewards

- You already carry a credit card for purchases

Limitations to consider:

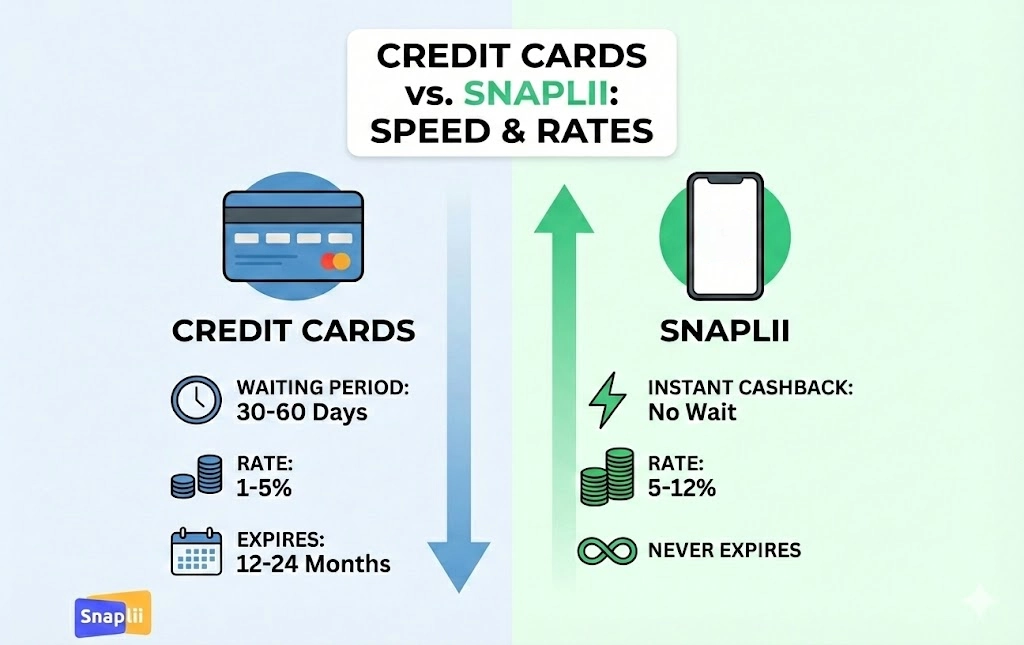

- Lower cashback rates (typically 1-5%)

- Waiting periods of 30-60 days for rewards to post

- Minimum redemption thresholds ($25+)

- Rewards may expire after 12-24 months

Gift card platforms like Snaplii work best when:

- You shop regularly at specific brands

- You want higher cashback rates (5-12%)

- You prefer instant rewards with no waiting

- You’re comfortable planning purchases slightly ahead

Key advantages:

- Immediate cashback on every purchase

- No minimum redemption amount

- Snaplii Cash never expires

- Higher return rates than most credit cards

- Works for everyday essentials across 9 categories (groceries, gas, dining, entertainment, fashion, beauty, travel, and more)

The most practical approach is identifying where you spend the most money each month, then choosing the cashback method that offers the best return for those specific categories.

Comparing Cashback Methods

| Feature | Credit Cards | Traditional Apps | Snaplii |

|---|---|---|---|

| Typical Cashback | 1-5% | 2-8% | 5-12% |

| Reward Speed | 30-60 days | 30-90 days | Instant |

| Minimum Redemption | Usually $25 | Varies ($5-$50) | None |

| Expiration | Often 12-24 months | Varies | Never |

| Usage Locations | Everywhere cards accepted | Specific retailers | 500+ brands |

| Setup Complexity | Low | Medium | Low |

The table illustrates key differences in how these programs operate. Credit cards offer universality but slower rewards and lower rates. Traditional cashback apps provide competitive rates but with waiting periods and tracking requirements. Snaplii focuses on higher instant cashback for gift card purchases at partnered brands.

Making Cashback Work for Your Spending

Effective cashback strategy starts with analyzing your actual spending patterns. Understanding where your money goes determines which cashback method delivers the most value.

Step 1: Track your spending for one month

- Groceries and supermarkets

- Gas and automotive

- Dining out and restaurants

- Coffee shops

- Online shopping

- Travel and transportation

- Entertainment

- Beauty and personal care

- Fashion and apparel

Step 2: Calculate potential savings by method

For example, if you spend $400 monthly on groceries:

- Credit card (2%): $8/month = $96/year

- Snaplii gift cards (5%): $20/month = $240/year

- Difference: $144 additional savings annually

Step 3: Choose your approach based on priorities

Choose credit cards if you value:

- Automatic rewards on all spending

- No advance planning required

- Building credit history

- Universal merchant acceptance

Choose Snaplii if you value:

- Higher cashback rates (5-12%)

- Instant reward availability

- No waiting periods or minimum thresholds

- Rewards that never expire

Important consideration: The ease of earning cashback shouldn’t encourage unnecessary spending. Focus on maximizing returns on purchases you already planned to make, not justifying new expenses because you’re earning rewards.

FAQ

A: Immediately after earning it. Snaplii Cash posts to your account as soon as you complete a gift card purchase. You can then use this balance to offset your next gift card order—there’s no waiting period, no minimum threshold, and no expiration date.

A: Absolutely. Many gift cards purchased through Snaplii work for both in-store and online purchases. For online use, you typically enter the gift card code at checkout just like any other payment method.

A: It depends on your spending habits and priorities. If you want the highest cashback rates (5-12%) with instant availability and no expiration, Snaplii works well for everyday purchases at partnered brands. If you prefer automatic rewards across all merchants without planning ahead, credit cards offer universal acceptance with lower rates (1-5%) and longer waiting periods.

Maximizing Your Cashback Potential

Understanding how cashback works is just the first step. The real value comes from building a consistent system that captures rewards across your regular spending without adding complexity to your life.

Getting started with Snaplii:

- Identify your top spending category (groceries, gas, dining, or coffee)

- Download the Snaplii app and browse available gift cards for brands you already use

- Start with one category to test the process

- Track your savings for one month to see the concrete impact

- Expand to other categories once comfortable with the routine

Categories Snaplii covers:

- Grocery stores and supermarkets

- Gas stations and automotive services

- Restaurants and fast food

- Coffee shops

- Online shopping and e-commerce

- Travel and transportation

- Entertainment and media

- Beauty and personal care

- Fashion and apparel stores

Making it a habit:

The key to consistent savings is integrating cashback into your existing routine. Before making a purchase at a partnered brand, check Snaplii first. Buy the gift card, then complete your purchase. This two-step process becomes automatic after a few transactions.

Over time, these small percentages accumulate into meaningful savings that can fund other financial goals—without changing what you buy or where you shop.