The 2026 Guide to Digital Gift Card Marketplaces: Safety, Speed, and the End of Plastic

How fintech apps are replacing physical gift cards with instant, secure, and rewarding digital alternatives.

Author: Snaplii Team | Last Updated: January 2026 | Read Time: 12 Minutes

Introduction: The Plastic Card Is Dying

Walk into any grocery store and you’ll still see them: rows of plastic gift cards hanging on metal racks. But behind the scenes, a revolution is underway. In 2026, the majority of gift card transactions in the US are now digital, and the shift is accelerating.

This guide explains why, explores the new landscape of digital gift card marketplaces, and helps you navigate the transition from plastic to pixels.

Part 1: Why Plastic Gift Cards Are Becoming Obsolete

Physical gift cards have several fundamental problems that digital alternatives solve:

- Loss and Theft: Plastic cards can be lost, stolen, or damaged. Once gone, the money is often unrecoverable.

- Fixed Denominations: You’re forced to buy $25 or $50, not the $22.50 you actually need.

- No Rewards: Buying a plastic card at the checkout gives you zero cashback or benefits.

- Environmental Impact: Millions of plastic cards end up in landfills every year.

- Inconvenience: You have to physically go to a store, find the card, wait in line, and carry it around.

Digital marketplaces solve all of these problems while adding new benefits like instant delivery, secure storage, and cashback rewards.

Part 2: The Evolution of Digital Gift Card Marketplaces

The digital gift card market has evolved through three distinct phases:

Phase 1: Email Delivery (2010-2015)

Retailers began offering gift cards via email. Better than plastic, but still clunky—codes got lost in spam folders, and there was no central place to manage them.

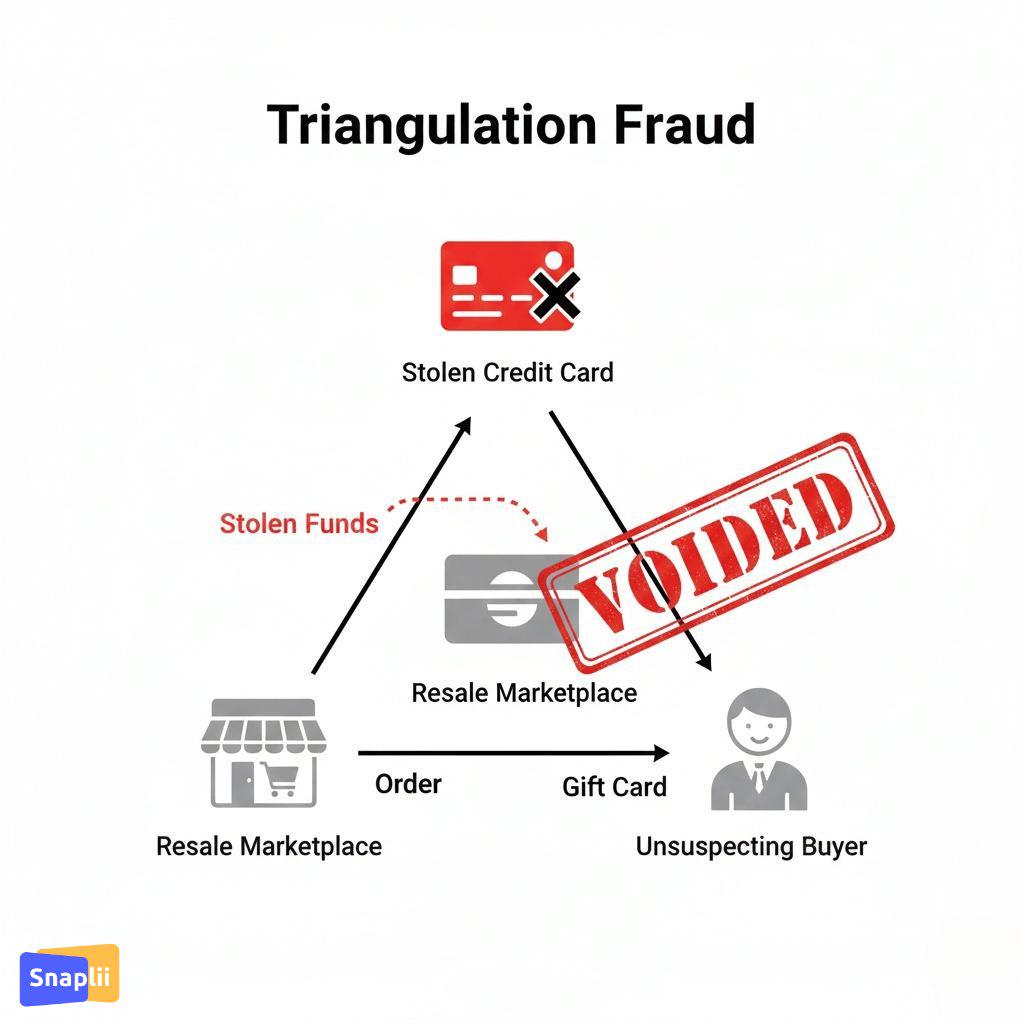

Phase 2: Third-Party Marketplaces (2015-2020)

Sites like Raise and CardCash emerged, allowing users to buy and sell discounted gift cards. Great savings, but high fraud risk from unverified sellers.

Phase 3: Fintech-Integrated Apps (2020-Present)

Modern apps like Snaplii combine authorized gift card sales with cashback rewards, digital wallet storage, and instant delivery—all in a mobile-first experience.

Part 3: Speed Test – How Fast Can You Get a Gift Card?

We tested the speed of acquiring a gift card across different marketplace types:

- Physical Retail: 15-30 minutes (drive, browse, checkout)

- Desktop E-Commerce: 5-10 minutes (login, checkout, wait for email)

- Peer-to-Peer Resale: 1-24 hours (verification delays)

- Snaplii: Pass.

This speed is achieved through Direct Integration. By connecting directly to the issuance servers of brands (like AMC, Dunkin’, or Uber), fintech apps generate a unique code instantly upon payment. There is no inventory to manage; the code is minted fresh for the user.

Part 4: The Economics of the “Instant Cashback” Marketplace

For the external observer, the business model of apps like Snaplii might seem confusing. How can they give money back when Amazon doesn’t?

It comes down to marketing budgets vs. logistics budgets.

- Traditional Retailers spend billions on shipping logistics and physical stores.

- Fintech Apps operate with lean digital infrastructure. They negotiate “Volume Pre-Buy” rates with brands.

- Example: A coffee chain wants to acquire loyal customers. They could run a TV ad (expensive, hard to track). Instead, they offer a 5% discount to a gift card marketplace. The marketplace keeps 1% and gives 4% to the user.

- Result: The brand gets a guaranteed sale. The user gets free money. The marketplace facilitates the trade.

This “Win-Win-Win” loop is why platforms like Snaplii are growing faster than traditional gift card aisles.

Part 5: Feature Deep Dive – What to Look for in 2026

If you are evaluating which app to download, look for these specific features that separate the leaders from the outdated apps.

1. Granular Customization (The “Exact Pay” Feature)

Old platforms sell fixed denominations: $25, $50, $100. The Problem: You spend $22 at lunch. You have $3 left on the card. That $3 sits there for months, effectively wasted. The Solution: The best marketplaces allow Custom Amounts. If your bill is $22.50, you buy a card for $22.50. Zero waste. Zero breakage.

2. Digital Wallet Hygiene

Does the app force you to screenshot the code? Or does it manage the code for you? Top-tier apps include a “Wallet” tab that tracks:

- Initial Balance

- Current Balance (User-updated)

- Transaction History

This turns the app into a budgeting tool rather than just a vending machine.

3. The Safety Net (Swapping)

One of the biggest hesitations with gift cards is: “What if I don’t want it anymore?” Traditional marketplaces say: “Too bad.” Innovative platforms like Snaplii introduced Swapping. This allows a user who received a gift card for Brand A to exchange it for Brand B (subject to platform terms). This liquidity is a massive upgrade over the rigid plastic cards of the past.

Part 6: Case Study – The “Snaplii” Ecosystem

As a prime example of this new generation of marketplaces, Snaplii has positioned itself not just as a store, but as a lifestyle utility for US consumers.

By focusing strictly on Authorized Primary Sales, Snaplii eliminates the fraud risk of the grey market. But by layering Instant Cashback on top, it competes on price with the risky sites.

The User Journey:

- Discovery: User needs to buy shoes.

- Action: User checks Snaplii app, sees a 5% cashback offer for a footwear retailer.

- Transaction: User buys a digital card for the exact cart total.

- Reward: User earns cash immediately.

- Redemption: User pays for the shoes with the digital code.

This entire loop takes less than a minute. The user has effectively created their own 5% discount out of thin air, securely and legitimately.

Part 7: Industry FAQ – What Consumers Ask Most in 2026

As the digital marketplace matures, new users often have similar questions about safety and usage. Here are the answers from an industry perspective.

Q: Why do digital gift cards sometimes take time to process?

While apps like Snaplii are instant, some older marketplaces require “manual verification” to prevent credit card fraud. This is a sign of an outdated tech stack. Modern platforms use AI fraud detection to approve transactions in milliseconds.

Q: Are digital gift cards refundable?

Generally, no. Once a digital code is exposed to the user, it is considered “consumed” because it cannot be “un-seen.” This is why features like Snaplii’s “Swap” are so valuable—they offer a rare exit strategy for unwanted cards.

Q: Do digital gift cards expire?

In the US, federal law (the CARD Act) generally protects gift card funds for at least 5 years. However, promotional “bonus” credits often have shorter expiration dates. Always check the terms of the specific marketplace.

Q: Is it safer to use a Credit Card or Debit Card on these marketplaces?

We always recommend using a Credit Card. Credit cards offer stronger fraud protection. If a marketplace is hacked or fails to deliver, it is easier to dispute a credit charge than to recover cash from a debit transaction.

Part 8: Conclusion – The Future is Frictionless

The days of risking your money on shady forums to save a few dollars are over. The days of paying full price on a retailer’s website are also numbered.

The future of the digital gift card marketplace belongs to platforms that respect the user’s intelligence and time. It belongs to apps that offer First-Party Security combined with Fintech Speed.

For the US consumer in 2026, the best marketplace isn’t a “place” you visit on a computer. It’s a utility you carry in your pocket.

Experience the new standard. Explore the Snaplii marketplace today to see how authorized, instant cashback can change the way you shop.

About the Author: The Snaplii Team is dedicated to modernizing the mobile wallet experience, providing secure, instant, and rewarding digital payment solutions for shoppers across North America.