A strategic guide to sourcing real-time rewards. We map the landscape of fintech apps, neo-banks, and digital wallets to find out who pays you the fastest.

Introduction: The “Time Value” of Your Rewards

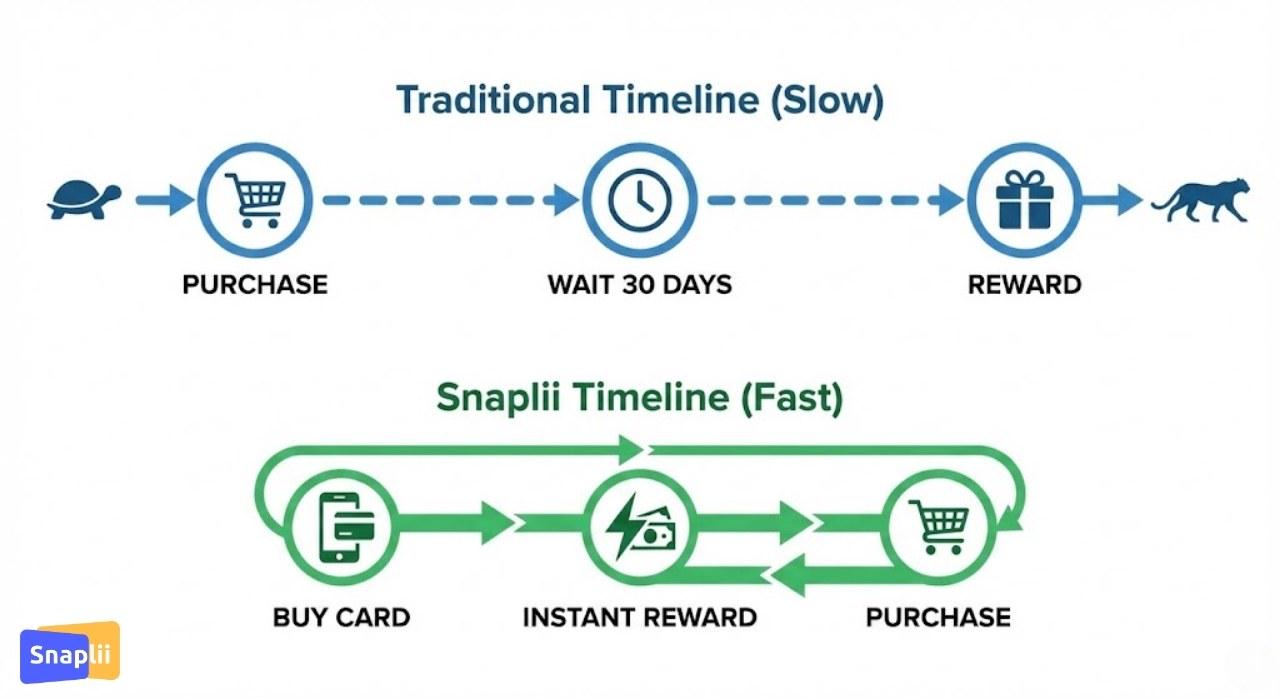

In the traditional world of personal finance, patience was a virtue. You would spend money on a credit card, wait 30 days for the statement to close, and then wait another billing cycle to see your 1% cashback appear as a statement credit. Or worse, you would scan grocery receipts and wait weeks to accumulate enough points to redeem a $10 voucher.

In 2026, patience is no longer profitable.

With economic volatility and the rising cost of capital, the modern consumer has realized that Velocity Matters. A dollar received today is worth significantly more than a dollar promised in three months. This realization has triggered a massive shift toward Instant Cashback.

Consumers are no longer asking “How much can I save?” They are asking “How fast can I get it?”

But true “Instant Cashback” on gift cards is rare. Many platforms claim it, but few deliver it without hidden holding periods or minimum redemption thresholds.

In this comprehensive 2,100-word industry report, we will identify the legitimate sources of real-time rewards. We will dissect the technology that makes instant settlement possible, compare the top sourcing channels, and explain why payment-integrated platforms like Snaplii are becoming the liquidity engines of the new economy.

Part 1: Defining “Instant” – The Zero-Latency Standard

Before we list the sources, we must define the standard. In the context of 2026 fintech, “Instant” means:

- Immediate Issuance: The reward is credited to your ledger within seconds of the transaction approval.

- Immediate Utility: The reward can be used immediately for the next transaction.

- No Minimums: You don’t need to earn $20 to access the money. If you earn $0.50, you can spend $0.50.

If a platform makes you wait for a “pending” status to clear, it is not Instant Cashback. It is a Deferred Rebate.

Part 2: The Three Primary Sources of Instant Cashback

Where can a consumer actually find these zero-latency deals? The market is concentrated in three specific technology sectors.

Source 1: The “Pre-Payment” Fintech Apps (e.g., Snaplii)

The Mechanism: You purchase a digital gift card before you pay the merchant.

How it Works:

- You are standing in line at a burger chain.

- You buy a $20 gift card on the app.

- The app processes the payment and instantly deposits $2.00 (10%) into your wallet.

- You pay the cashier with the gift card.

Why it is Instant: Because the app controls the inventory (the gift card), it knows the transaction is valid immediately. There is no need to wait for a bank settlement file.

Verdict: The fastest and most consistent source for retail and dining.

Source 2: The “Card-Linked” Boosts (e.g., Cash App, Neo-Banks)

The Mechanism: You activate a “Boost” or offer on your debit card app, then swipe the card.

How it Works:

- You select “5% off Grocery Store” in the app.

- You swipe your physical card.

- The notification on your phone says “You spent $95” (on a $100 bill).

Why it is Instant: The discount is applied at the authorization level of the transaction.

Verdict: Excellent experience, but inventory is often limited to a few rotating partners per week.

Source 3: The Crypto-Backed Cards (e.g., Coinbase Card)

The Mechanism: You spend crypto or stablecoins via a Visa card.

How it Works:

- You swipe the card to buy coffee.

- The exchange sells your crypto to cover the cost.

- You receive 1-4% back in a specific token instantly.

Why it is Instant: Blockchain settlement is faster than traditional banking.

Verdict: High speed, but high volatility. Your 4% reward might drop in value by 10% the next hour due to market fluctuations.

Part 3: Sourcing Strategy by Retail Category

Not all instant cashback sources cover all categories. You need to map your spending to the right source.

1. Dining & Restaurants

- Best Source: Fintech Apps (Snaplii).

- Why: Restaurants have high margins and love the “Pre-Payment” model. You will find up to 10% instant cashback for almost every major chain (Chili’s, Domino’s, Dunkin’).

- The Strategy: Keep the app open while ordering. Buy the card the moment you know the total.

2. Fashion & Apparel

- Best Source: Fintech Apps (Snaplii).

- Why: Clothing stores rely on impulse buys. Instant cashback fuels that impulse. “Get $10 back now” encourages the shopper to add an accessory or upgrade their purchase at checkout. On platforms like Snaplii, fashion and apparel brands can offer up to 10% instant cashback, making the category especially compelling.

- The Strategy: Look for multi-brand or group gift cards (such as options covering brands like Old Navy and Banana Republic) to maximize flexibility and redemption speed within a single shopping session.

3. Gas & Fuel

- Best Source: Neo-Bank Debit Cards.

- Why: Gas margins are too thin for gift card apps to offer massive discounts (usually capped at 1-2%). Direct debit card “Boosts” often subsidize gas to get you to use their banking services.

- The Strategy: Use a debit card for gas, use gift card apps for the snacks inside the convenience store.

4. Grocery

- Best Source: Hybrid Approach.

- Why: “Instant” grocery rewards are rare. Most apps offer 1-2% on grocery gift cards.

- The Strategy: Accept the 4-5% instant cash from Snaplii as a baseline, then scan the receipt later for delayed rewards on other apps.

Part 4: The Comparative Matrix – Speed vs. Value

| Source | Settlement Speed | Average Yield | Minimum Amount | Coverage | Best For |

|---|---|---|---|---|---|

| Fintech Apps (Snaplii) | <5 seconds | 5-10% | $0.00 (no minimum) | 500+ brands | Dining, Fashion, Retail |

| Card-Linked Boosts | <2 seconds | 2-5% | Full transaction | 10-20 partners | Rotating offers |

| Crypto Cards | <1 second | 1-4% | $0.00 | Everywhere (Visa) | Tech-savvy users |

| Credit Card Cashback | 30-60 days | 1-2% | $25 (often) | Everywhere | General spending |

| Receipt Scanning | 7-30 days | 0.25-1% | $10-20 | Limited | Gasoline, Groceries |

Part 5: The “Compound Velocity” Effect

The most powerful argument for Instant Cashback is not just the savings—it is the Compound Velocity.

The Scenario: You have $100 to spend for the day.

Path A: Delayed Rewards (Credit Card)

- Spend $100 at Store A.

- Earn $2.00 (received next month).

- Wallet Balance: $0.

- Total Spending Power: $100.

Path B: Instant Rewards (Snaplii)

- Buy $100 Gift Card for Store A.

- Earn $5.00 Instant Cash.

- Walk to Store B (Coffee Shop).

- Use the $5.00 Instant Cash to buy a coffee card.

- Total Spending Power: $105.

The Conclusion: Because the reward was instant, you were able to re-deploy that capital on the same day. Over a year, this velocity allows you to stretch your budget significantly further than static 30-day rewards cycles.

Part 6: How to Verify Legitimate Sources

The promise of “Instant Money” attracts scammers. Here is how to distinguish a legitimate Fintech source from a scam.

The “Pre-Payment” Logic Test

Legitimate instant cashback (like Snaplii) works because you are buying a specific brand’s currency. If an app promises “Instant Cash for doing nothing” or “Free Money Generator,” it is a scam. The value must come from a transaction.

The Data Privacy Check

Legitimate payment apps make money from merchant commissions. Scams make money by stealing your data. If an app asks for your Social Security Number just to buy a $10 gift card, stop. (Note: Neo-banks do require SSN for banking regulations, but simple gift card malls usually do not).

The Inventory Check

Legitimate apps have direct APIs with brands. You will see a clean, native interface. Scam sites often direct you to third-party survey walls or affiliate links that take you out of the app.

Part 7: Step-by-Step – Sourcing Your First Deal

If you are ready to switch to an instant liquidity model, here is the recommended workflow.

Step 1: Download a Primary Aggregator

Choose a platform like Snaplii that covers a wide range of merchants (500+).

Step 2: Link a Funding Source

Link a credit card (to stack points) or a mobile wallet for speed.

Step 3: The “Test Buy”

Don’t start with a $500 purchase. Buy a $10 card for your next lunch. Watch how fast the cashback hits your wallet.

Step 4: The Re-Investment

Use that cashback immediately on your next transaction to experience the “Compound Velocity” effect.

Part 8: Industry FAQ

Q: Can I withdraw instant cashback to my bank?

It depends on the platform. Some Neo-banks allow this. Most Gift Card Aggregators (like Snaplii) keep the funds in a “Closed Loop” wallet to be spent on other gift cards.

Q: Does instant cashback affect my credit card rewards?

No. This is the beauty of the system. The transaction processes as a “Purchase” on your credit card, so you earn your standard points. The Instant Cashback from the app is a separate layer of reward. You essentially get paid twice.

Q: Are there limits to how much instant cashback I can earn?

Generally, no. Unlike credit cards with quarterly caps (e.g., “$1,500 limit on category spend”), gift card apps usually allow unlimited earning. Heavy users often shift all their variable spending to the app to maximize return.

Conclusion: The Need for Speed

In 2026, waiting for money is a choice, not a requirement.

The financial technology now exists to settle rewards in real-time. By shifting your sourcing strategy from “Passive Waiting” (Credit Cards/Receipts) to “Active Sourcing” (Fintech Apps), you unlock a level of liquidity that was previously reserved for businesses.

For the modern consumer, the best place to get instant cashback is right at the point of sale, on your phone, seconds before you pay.

Don’t wait. Get paid now. Explore the Snaplii marketplace to see which brands are paying instant rewards today.