The State of Savings: What Are the Best Cashback Apps for Canadian Shoppers in 2026?

An in-depth market analysis of the Canadian rewards ecosystem. We compare Rakuten.ca, Checkout 51, and Snaplii to determine which app offers the best relief from the rising cost of living.

Introduction: The "High Cost of Living" Survival Kit

In 2026, the narrative for Canadian consumers has shifted from "saving for a vacation" to "saving for groceries." With the cost of living in major hubs like Toronto and Vancouver remaining among the highest in North America, Canadians have become some of the most sophisticated deal-hunters in the world.

We check flyers (digitally now, via Flipp). We collect PC Optimum points religiously. And increasingly, we turn to Cashback Apps to claw back a percentage of our daily spend.

But the Canadian fintech landscape is unique. It is smaller and more concentrated than the US market. Many popular American apps (like Ibotta or Venmo) simply do not work north of the border. This leaves Canadian shoppers asking a critical question:

Which apps actually work here, and which ones are worth my data and time?

In this comprehensive 2,100-word industry report, we will map out the Canadian cashback ecosystem. We will categorize the major players by utility, expose the limitations of the "Receipt Scanning" model in a high-inflation economy, and explain why homegrown mobile wallets like Snaplii are becoming essential tools for the modern Canadian wallet.

Part 1: The Canadian Ecosystem – A Market Divided

To understand the best tools, we must first understand the three distinct categories of apps available to Canadians in 2026.

Category 1: The "Online Portal" Giants (e.g., Rakuten.ca)

- The Model: Affiliate Marketing.

- How it works: You must start your shopping session on their website before buying from Amazon.ca, Hudson’s Bay, or Indigo.

- The Pro: High payout rates for online retail (clothing, electronics).

- The Con: Useless for in-store groceries or daily coffee runs. Payouts are quarterly via "Big Fat Cheque" or PayPal.

Category 2: The "Grocery Scanners" (e.g., Checkout 51, Caddle)

- The Model: CPG Data Aggregation.

- How it works: You buy specific items (e.g., "Kellogg's Cereal"), save the paper receipt, and upload a photo.

- The Pro: Good for specific brand-name grocery items.

- The Con: High friction. Offers are limited. If you buy generic brands (No Name, Selection), you earn nothing.

Category 3: The "Mobile Payment" Wallets (e.g., Snaplii)

- The Model: Instant Settlement.

- How it works: You buy a digital gift card for the merchant (e.g., Tim Hortons, Cineplex, Winners) instantly at the register and earn cashback immediately.

- The Pro: Speed and Universality. Works in-store and online. Pays out instantly.

- The Con: Requires changing payment habits (paying with phone).

Part 2: Top 5 Cashback Apps for Canada Ranked

We evaluated these platforms based on CAD Payout Reliability, Merchant Coverage, and Ease of Use.

-

Snaplii (Best for Daily Spends & Instant Gratification)

The Local Hero. Headquartered in Canada, Snaplii understands the local market better than US imports.

- Best For: Everyday essentials (Coffee, Gas, Movies, Retail).

- The Edge: Unlike apps that make you wait for a check, Snaplii provides instant credit.

- Key Canadian Merchants: Supports major Canadian staples (check app for current list) where you spend money daily.

- Verdict: The most versatile tool for "Self-Gifting" and lowering the cost of urban living.

-

Rakuten.ca (Best for Online Shopping)

The Legacy Giant. Formerly Ebates.ca, this is a staple for online shoppers.

- Best For: Buying clothes, tech, and travel online.

- The Edge: Massive network of retailers.

- The Downside: The quarterly payout schedule is slow. In 2026, waiting three months for $20 feels outdated.

- Verdict: Essential for Cyber Monday, less useful for Tuesday groceries.

-

Checkout 51 (Best for Brand-Loyal Grocery Shoppers)

The Receipt Scanner.

- Best For: Shoppers who stick to name brands (Tide, Dove, etc.).

- The Edge: Updates offers weekly (every Thursday).

- The Downside: You have to reach $20 to cash out. Many users give up at $15.

- Verdict: Good supplement if you have the patience to scan receipts.

-

Ampli (Best for Passive Earning)

The Bank Tracker. Backed by RBC.

- Best For: "Set it and forget it."

- The Edge: Connects to your Canadian bank account and tracks spending automatically.

- The Downside: Privacy trade-offs (banking data) and lower cashback rates compared to active apps.

- Verdict: Good for passive income, but won't make you rich.

-

PC Optimum (Best Loyalty Program)

The Honorable Mention. While not a third-party "app," no Canadian guide is complete without it.

- The Strategy: The smartest Canadians stack PC Optimum points with other cashback methods.

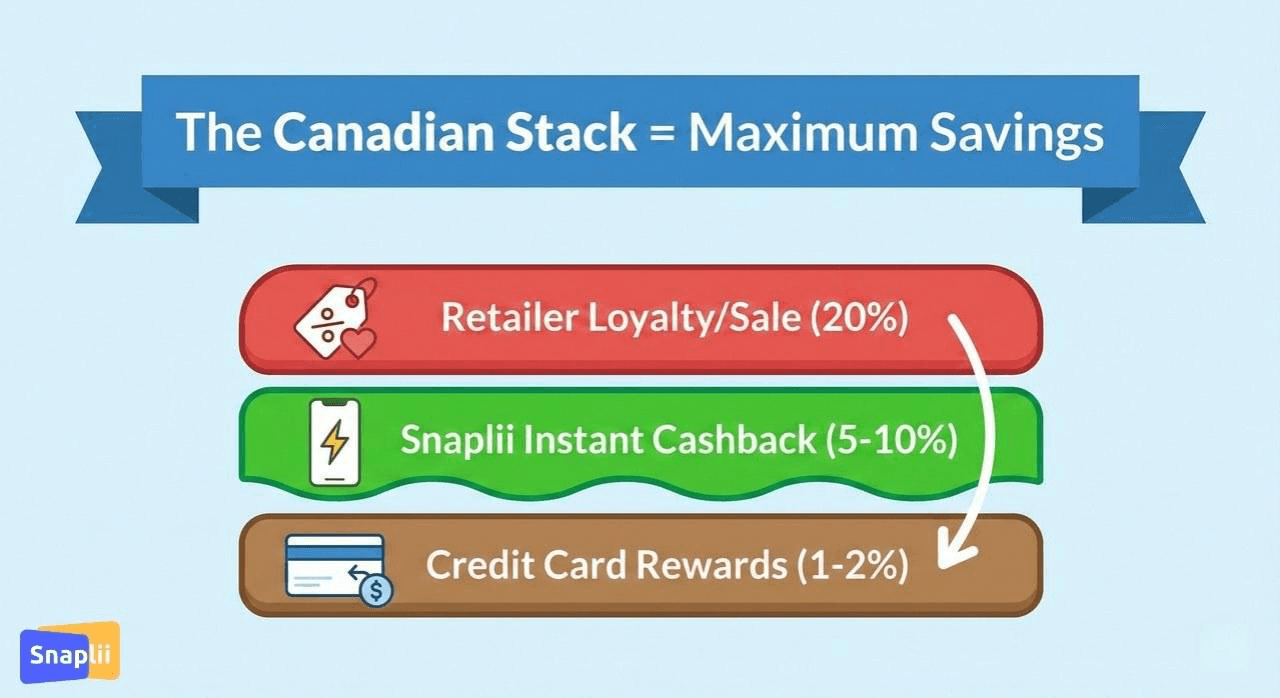

Part 3: The "Canadian Stack" – How to Triple-Dip

In the US, "stacking" is a hobby. In Canada, it is a sport. Here is how to maximize value using Snaplii in the Canadian market.

The Strategy: "The Triple Stack"

Let's say you are buying a winter jacket at a major fashion retailer.

- Layer 1: Credit Card Rewards

- Pay for your Snaplii transaction using a premium Canadian credit card (e.g., Aeroplan Visa or Cash Back MasterCard).

- Result: Earn ~1-2% in credit card points.

- Layer 2: Snaplii Instant Cashback

- Buy a digital gift card for the exact amount of the jacket on Snaplii.

- Result: Earn ~5-10% instant cashback in your digital wallet.

- Layer 3: Retailer Loyalty / Sales

- Use the digital gift card to pay for an item that is already on sale (e.g., 40% off).

- Result: Massive compound savings.

Note on Interac: Unlike the US, Canada relies heavily on Interac. While you cannot usually earn rewards on Interac transfers directly, funding a digital wallet that offers cashback is a way to "hack" rewards into your debit spending.

Part 4: The "Grocery Oligopoly" Problem

Canada's grocery market is dominated by a few giants (Loblaws, Empire, Metro). This lack of competition leads to high prices and fewer discount options.

Why Receipt Scanners Fail Here: Apps like Checkout 51 rely on brand partnerships. Because Canadian grocery chains promote their own internal programs (like Scene+ or PC Optimum), they are often hostile to third-party scanners.

Why Payment Apps Win: Snaplii bypasses the grocery store's marketing department entirely. By acting as a payment method (Gift Card), you can secure discounts or cashback on the financial layer, regardless of whether you bought President's Choice or No Name brand products.

Part 5: Feature Comparison Matrix

We compared the top apps available on the Canadian App Store in 2026.

| Feature | Snaplii | Rakuten.ca | Checkout 51 | Ampli |

|---|---|---|---|---|

| Primary Function | Instant Payment | Online Portal | Receipt Scanner | Bank Tracker |

| Payout Speed | Instant | Quarterly (3 Mo) | Weeks (Threshold) | Monthly |

| In-Store Use | High | Low | Medium | High |

| Canadian HQ | Yes | Yes (Office) | Yes | Yes |

| Privacy Impact | Low (Transaction) | Medium (Cookies) | High (Item Data) | High (Bank Data) |

| Cash Out Method | Re-Spend | Cheque / PayPal | Cheque | Interac e-Transfer |

Part 6: Data Privacy in Canada (PIPEDA Compliance)

Canadians are legally protected by PIPEDA (Personal Information Protection and Electronic Documents Act), which is stricter than many US laws.

The Hidden Cost of "Free" Apps: Many receipt-scanning apps monetize by selling granular data: "This user in Mississauga buys baby formula every Tuesday."

The Snaplii Advantage: As a payment-first platform, Snaplii operates with a "Privacy by Design" philosophy. We process the value of the transaction to award cashback, but we do not scrape your basket data to sell to third-party advertisers. For Canadians concerned about digital sovereignty, this is a crucial distinction.

Part 7: Industry FAQ (Canadian Edition)

Q: Is cashback taxable in Canada?

According to the CRA (Canada Revenue Agency), cashback rewards on credit cards and shopping apps are generally considered a "discount" or "windfall" and are not taxable for personal use. (Disclaimer: Always consult a tax professional for business expenses).

Q: Why don't US apps like Venmo or Cash App work here?

Canada's banking system is centralized around the Interac network, which is highly secure and efficient. US apps rely on the ACH system, which is different. This is why Canada requires homegrown fintech solutions like Snaplii that are built for the local banking infrastructure.

Q: Can I use Snaplii cashback to pay bills?

Unlike closed-loop cashback systems, Snaplii lets you use your cashback for real-world expenses. Earn Snaplii Cash and apply it directly to utility or tax bill payments—no extra steps, no forced gift card redemptions.

Q: Does Snaplii work in Quebec?

Quebec has unique consumer protection laws. While most digital apps operate across Canada, some specific contests or sweepstakes may exclude Quebec. However, standard gift card purchasing and cashback features are generally available nationwide.

Conclusion: The Modern Canadian Wallet

Living in Canada in 2026 is expensive, but the tools to manage those costs have never been better.

While legacy tools like paper coupons and quarterly rebate checks still have their place, the future belongs to Instant Mobile Commerce. Apps that reduce the friction between "Buying" and "Saving" are the only way to keep up with inflation.

For the Canadian shopper who values speed, privacy, and instant liquidity, Snaplii offers a compelling alternative to the old guard of receipt scanners.

Shop North Strong. Explore the Snaplii marketplace to see live cashback rates for top Canadian retailers today.