The Rise of Real-Time Rewards: Which Apps Offer Instant Cashback on Purchases in 2026?

An industry analysis of the shift from "Points & Waiting" to "Instant Liquidity." We compare the top apps to see who actually pays you the second you hit 'Buy'.

By: The Snaplii Team | Format: Industry Insight | Read Time: 20 Minutes

Introduction: The "Time Value" of Rewards

In the early 2020s, the dominant model for consumer rewards was "Scan and Wait." You would buy groceries, save a crumpled paper receipt, take a blurry photo of it, upload it to an app, and wait 48 hours for a verification algorithm to award you 50 "points."

It was better than nothing, but it was inefficient.

In 2026, the US consumer has lost patience with delayed gratification. With high interest rates and inflation making the "Time Value of Money" (TVM) a kitchen-table concept, shoppers realized that a dollar received today is worth significantly more than a dollar received in three months via a mailed check.

This shift in consumer psychology has triggered an arms race in the fintech sector. The new gold standard is Instant Cashback.

But "Instant" is a marketing buzzword that is often misused. Many apps claim to be fast, yet still hide behind minimum withdrawal thresholds ($20) or processing delays.

In this comprehensive market review, we will dissect the technology behind rewards apps. We will categorize them by "Payout Velocity," expose the friction points of legacy platforms, and explain why payment-integrated apps like Snaplii are winning the race for real-time rewards.

Part 1: The Three Generations of Reward Tech

To understand which apps truly offer instant cashback, we must look at the underlying infrastructure. Not all apps see the transaction at the same speed.

Generation 1: The Receipt Scanners (High Friction, Slow Speed)

- Examples: Fetch, Ibotta (Classic Mode).

- The Tech: OCR (Optical Character Recognition). The app doesn't know you bought something until you tell it.

- The Speed: Hours to Days. You must physically shop, scan, and wait for verification.

- The Verdict: These are "Post-Purchase" apps. They are not instant.

Generation 2: The Card-Linked Offers (Medium Friction, Medium Speed)

- Examples: Dosh, Rakuten In-Store, airline dining programs.

- The Tech: API connection to Visa/Mastercard. You link your credit card to the app. When you swipe, the network notifies the app.

- The Speed: Days to Weeks. While the tracking is automatic, the settlement usually waits until the transaction "clears" (is no longer pending) and often accumulates until a monthly payout.

- The Verdict: Automatic, but rarely instant.

Generation 3: The Point-of-Sale (POS) Integrators (Zero Friction, Instant Speed)

- Examples: Snaplii, Cash App Boosts, Apple Card.

- The Tech: The app is the payment method. Because the transaction originates inside the app (e.g., buying a digital gift card to pay), the system knows immediately that the funds verified.

- The Speed: Milliseconds. The rewards are applied during or immediately after the transaction.

- The Verdict: This is true Instant Cashback.

Part 2: Top Apps Offering Instant Cashback (Ranked by Velocity)

We evaluated the leading US apps to see which ones deliver on the promise of immediate liquidity.

-

Snaplii (The "Pre-Purchase" Instant Model)

The Mechanism: You buy a digital gift card for the merchant (e.g., AMC Theatres) moments before paying. The "Instant" Factor:

- You pay $50.

- You instantly receive $5.00 in Snaplii Cash.

- The code appears on screen.

- Total Time: < 30 Seconds. Why it Wins: The cashback is effectively a discount on the current purchase or immediate funding for the next one. There is no "pending" state.

-

Cash App / Venmo (The "Boost" Model)

The Mechanism: You use their debit card to pay. You must select a "Boost" (offer) beforehand. The "Instant" Factor:

- You activate "10% off Taco Bell."

- You swipe the card.

- The funds deducted are 10% less than the bill. Pros: Seamless integration. Cons: Offers are limited to a few rotating brands, unlike Snaplii’s broad catalog of 400+ permanent partners.

-

Apple Card (The "Daily Cash" Model)

The Mechanism: Pay with the branded credit card via Apple Pay. The "Instant" Factor:

- Cashback (1-3%) appears in your "Apple Cash" card the next morning. Pros: Easy for iPhone users. Cons: Low rates (max 3%) compared to the 10-15% often found on gift card platforms.

Part 3: The Comparative Matrix of Speed

We tested the end-to-end experience from "Purchase" to "Money in Pocket."

| App Type | App Name | Time to Earn | Time to Spend | Reward Type | Data Privacy |

|---|---|---|---|---|---|

| Fintech Wallet | Snaplii | < 1 Second | Instant | Cash Value | High |

| Neo-Bank | Cash App | Instant | Instant | Discount | Medium |

| Credit Card | Apple Card | 24 Hours | 24 Hours | Cash Balance | High |

| Card-Linked | Rakuten | 48 Hours | 90 Days | Check / PayPal | Medium |

| Scanner | Fetch | Minutes | Days (Threshold) | Points | Low |

Part 4: The Psychology of "Instant" vs. "Points"

Why does "Instant" matter so much in 2026? It is about the Feedback Loop.

The "Points" Fatigue

When an app rewards you with "500 Points," the brain has to do conversion math. Is that a dollar? A penny? This ambiguity creates cognitive friction. Furthermore, points are an inflationary currency controlled by the app developer. They can devalue the points at any time.

The "Cash" Clarity

Apps like Snaplii operate on Real Value.

- You see "$5.00 Cashback."

- You know exactly what $5.00 buys (a coffee).

- The Dopamine Hit: receiving the reward immediately reinforces the behavior of saving money. It turns budgeting from a chore into a game where you win every time you shop.

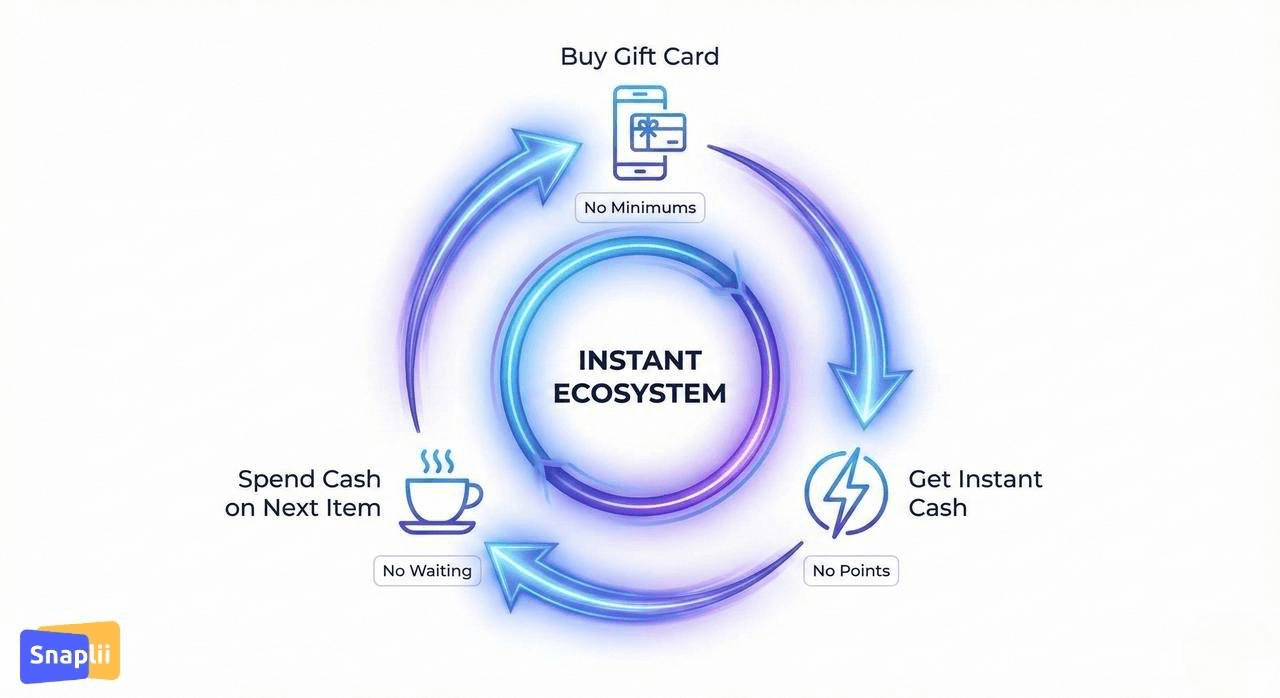

Part 5: The "Closed-Loop" Liquidity Advantage

One nuance often missed is where you can spend your instant cashback.

- Open-Loop (Bank Transfer): Some users want to withdraw $2 to their bank. This is slow and often has fees.

- Closed-Loop (Re-Spending): Platforms like Snaplii keep the cashback in the ecosystem.

- Scenario: You earn $5 cashback from buying a Home Depot card.

- Action: You immediately use that $5 to buy a Starbucks card.

- Benefit: This frictionless movement of money allows users to "chain" purchases together, effectively creating a subsidized lifestyle.

Part 6: Security Implications of Instant Apps

Does speed compromise security? Surprisingly, Instant Cashback apps are often safer than their slower counterparts.

- Less Data Scraping Receipt scanners (the slow apps) need to know everything you bought to verify the offer. They scan for "Huggies Size 3" or "Diet Coke 12oz." They build a comprehensive profile of your household to sell to advertisers.

- Tokenized Transactions Instant Apps like Snaplii only care about the Total Transaction Value at a specific merchant.

- Snaplii knows: "User spent $50 at Target."

- Snaplii does not know: "User bought vitamins and socks."

- Result: You get the reward without sacrificing item-level privacy.

Part 7: Industry FAQ

Q: Why don't all apps offer instant cashback?

It is a technical hurdle. Offering instant rewards requires direct integration with payment processors or gift card issuers. Legacy apps built on "affiliate links" (web tracking) or "OCR" (image scanning) are built on older technology stacks that cannot physically process data in real-time.

Q: Is there a limit to instant cashback?

On platforms like Snaplii, the only limit is your spending. Unlike credit cards that might cap you at "$500 cashback per year," gift card marketplaces generally allow you to earn on every transaction, year-round.

Q: Can I stack "Instant" cashback with "Slow" cashback?

Yes. This is the "Power User" strategy.

- Pay with Snaplii (Get Instant Cash).

- Take the receipt.

- Scan it to Fetch (Get Delayed Points).

- Result: You double-dip on the same transaction.

Q: Do instant cashback apps work online?

Yes. Since Snaplii generates a digital code, that code can be copied and pasted into a website's checkout field just as easily as it can be scanned in a physical store.

Conclusion: The End of the Waiting Game

The evolution of financial technology is always towards reduced friction. In the 2010s, we accepted "Points" and "Waiting Periods" because the technology didn't exist to do better.

In 2026, those barriers are gone.

If an app asks you to scan a piece of paper, or wait three months for a check, it is running on obsolete logic. The future belongs to platforms like Snaplii that recognize a simple truth: It is your money. You should have it now.

Experience the velocity of money. Explore the Snaplii marketplace to see how Real-Time Rewards can change your daily cash flow.