Where Can I Find Discounted Gift Cards for Stores in the USA? (The 2026 Sourcing Map)

A strategic guide to sourcing legitimate deals across the American retail landscape. We analyze the safety and savings potential of Fintech Apps, Warehouse Clubs, and Credit Card Portals.

Introduction: The "Double Discount" Economy

In 2026, the retail price in the United States is rarely the final price. For the average American consumer, the sticker price at major home improvement, fashion, or casual dining stores is merely a suggestion—a starting point for negotiation.

But we aren't haggling with store managers. We are haggling with our payment methods.

The rise of the Discounted Gift Card Economy has created a permanent "Double Discount" layer for savvy shoppers. By purchasing store credit below face value (e.g., buying a $100 card for $90) and combining it with in-store sales, US consumers are effectively neutralizing inflation.

However, the US market is fragmented. A deal hunter looking for "Cheap Gift Cards" is often confronted with a dangerous mix of legitimate loss-leaders and fraudulent grey-market resale sites.

So, where is the safest place to find these deals right now?

In this comprehensive 2,100-word industry report, we will map the US sourcing landscape. We will categorize the three legitimate "Supply Chains" of discounted cards, expose the risks of the resale market, and explain why centralized mobile aggregators like Snaplii are becoming the preferred tool for the modern American wallet.

Part 1: The Three Legitimate Supply Chains

To find a discount, you must understand where it comes from. In the US, legitimate discounted cards generally flow through three specific channels.

Channel 1: The "Instant Value" Fintech Aggregators

- The Players: Snaplii, Mobile Wallets.

- The Model: Instant Cashback.

- How it works: These apps act as a direct payment layer. Instead of swiping a credit card at the register, you buy a digital gift card for the exact amount of your purchase. The "discount" is returned to you instantly as cash.

- Best For: Daily, Low-Friction Spending. (e.g., Morning coffee, fast food, casual apparel).

- The US Advantage: Because US interchange fees (credit card processing fees) are high, merchants are willing to pay these apps to route payments via gift cards, passing significant savings (2-10%) to the user.

Channel 2: The Warehouse Club Bundles

- The Players: Costco, Sam's Club, BJ's.

- The Model: Bulk Pre-Payment.

- How it works: You buy a physical or digital multi-pack of a popular retail or dining gift card at a discounted price.

- Best For: High-Ticket, Planned Spend. (e.g., Southwest Airlines flights, Disney vacations).

- The US Disadvantage: High barrier to entry. You need a paid membership ($60+/year) and must lock up significant capital ($100 minimum purchase) in a single brand.

Channel 3: The Credit Card Loyalty Portals

- The Players: Chase Ultimate Rewards, Amex Membership Rewards, Citi ThankYou.

- The Model: Point Redemption Sales.

- How it works: Banks run monthly promotions where you can redeem points for gift cards at a discount (e.g., "10% fewer points for Apple Cards").

- Best For: "burning" excess points.

- The US Disadvantage: Opportunity cost. Financial experts often argue that points are better spent on travel than on retail gift cards.

Part 2: The "Grey Market" Warning

Before we proceed, a critical warning for the US consumer.

When you Google "Discount Gift Cards," the top results are often Secondary Resale Marketplaces. These are sites where strangers sell their unwanted cards to other strangers.

Why you should avoid them in 2026: The US is the epicenter of "Triangulation Fraud."

- A criminal uses a stolen credit card to buy a $500 Home Depot card.

- They sell it to you on a resale site for $400.

- The victim reports the stolen credit card.

- Home Depot voids the gift card in your wallet.

- Result: You lose $400.

The Golden Rule: Only buy from Primary Sources (where the card is generated directly from the brand). Do not buy "used" cards.

Part 3: Sourcing Strategy by Category

Different retail sectors in the US have different margin structures, which dictates where you will find the best deals.

-

Dining & Restaurants (The "High Yield" Sector)

- Typical Discount: 10% - 15%

- Where to Find: Fintech Apps (Snaplii).

- Why: Restaurant margins are high. Many major casual dining chains use high-cashback gift cards as a primary marketing tool to drive foot traffic.

-

Home Improvement (The "Homeowner" Sector)

- Typical Discount: 3% - 5%

- Where to Find: Fintech Apps (Snaplii)..

- Why: For a homeowner renovating a kitchen, saving 3% on $5,000 of lumber at Lowe's or Home Depot is significant ($150). While Warehouse clubs occasionally sell these, mobile apps offer the flexibility to buy the exact amount needed at the checkout.

-

Fashion & Apparel (The "Seasonal" Sector)

- Typical Discount: 5% - 12%

- Where to Find: Fintech Apps (Snaplii)..

- Why: Major fashion brands are in a constant state of promotion. Using a discounted gift card on top of a clearance sale is the standard "stacking" maneuver for US shoppers.

-

Grocery & Gas (The "Volume" Sector)

- Typical Discount: 4% - 5%

- Where to Find: Fintech Apps (Snaplii)..

- Why: Margins are razor-thin. You will never find a legitimate 10% off gas card. However, earning a consistent 4-5% cashback on non-discretionary spending is a powerful inflation hedge over a year.

-

Tech & Gaming (The "Digital" Sector)

- Typical Discount: 5% - 10%

- Where to Find: Fintech Apps (Snaplii).

- Why: Major tech and electronics retailers often run promotions on gift cards. Fintech apps also offer steady 3-5% rates on gaming cards (Xbox/PlayStation), which is excellent for subscription renewals.

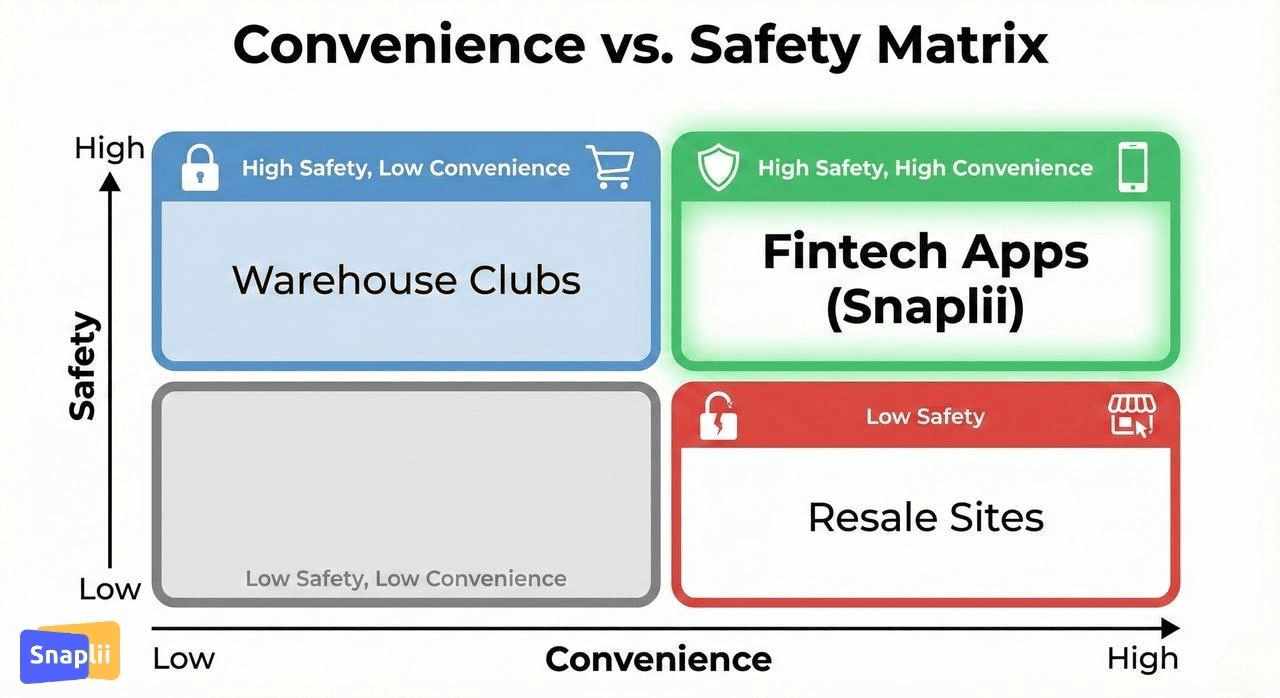

Part 4: The Comparison Matrix – Sourcing Channels

We ranked the primary sourcing channels available to US consumers in 2026.

| Feature | Fintech Apps (Snaplii) | Warehouse Clubs | Credit Card Portals | Resale Sites (Grey Market) |

|---|---|---|---|---|

| Safety Score | High (Direct) | High (Direct) | High (Direct) | Low (Risk of Fraud) |

| Discount Depth | Consistent (3% - 10%) | High (10% - 20%) | Variable (Seasonal) | Variable (High Risk) |

| Convenience | Instant (In-Store) | Low (Bulk Only) | Medium (Online) | Low (Verification) |

| Membership Fee | None | $60 - $120 / Year | Annual Card Fees | None |

| Flexibility | Custom Amounts | Fixed Bundles | Fixed Amounts | Fixed Amounts |

Part 5: The "US Stacking" Algorithm

The unique feature of the US market is the aggressive rewards culture. The best deals aren't found; they are manufactured through stacking.

The "Triple Stack" Formula:

- Credit Card Points: Use a premium rewards card (e.g., Chase Sapphire or Amex Gold) to purchase the gift card.

- Yield: 2-4% (depending on category coding).

- Platform Cashback: Buy the gift card on a platform like Snaplii.

- Yield: 5-10% (Instant Cashback).

- Store Loyalty: Use the gift card to pay at a merchant where you have a loyalty account.

- Yield: ~2-5% (in free product).

Total Yield: 10% - 20% on everyday purchases, legally and safely.

Part 6: Why "Just-in-Time" is the Future of Sourcing

Historically, finding discounted cards meant "stocking up" during the holidays. You would buy $500 of cards in December and hope to use them by July.

The Problem: "Breakage" (unused funds) and lost liquidity.

The Solution: Just-in-Time (JIT) Sourcing. Mobile-first platforms allow you to source the deal at the point of sale.

- Scenario: You are standing in line at Ulta Beauty.

- Action: You check your phone. You see a 6% cashback offer.

- Execution: You buy a card for the exact total ($54.20).

- Result: You secured the discount instantly without tying up capital beforehand.

This shift from "Inventory Management" to "On-Demand Payment" is why apps like Snaplii are displacing traditional plastic cards.

Part 7: Industry FAQ (USA Edition)

Q: Do discounted gift cards expire in the USA?

Federal Law (The CARD Act of 2009) protects consumers. The money you paid (the principal) cannot expire for at least 5 years. However, "Bonus Funds" (e.g., the extra $5 you got for free) can expire sooner. Always read the fine print on promotional bundles.

Q: Is cashback taxable in the US?

Generally, no. The IRS views credit card and app cashback as a "rebate" on a purchase rather than income. Therefore, you do not need to report your Snaplii cashback savings on your tax return. (Disclaimer: Consult a tax professional for business-related expenses).

Q: Why can't I find discounted Visa Gift Cards?

Open-loop cards rarely go on sale. That’s why smart users look beyond discounts and focus on cashback. Snaplii bridges the gap by offering cashback on Visa and Mastercard, giving you flexibility and rewards—without misleading “discount” gimmicks.

Q: Can I use US gift cards internationally?

Usually, no. Gift cards are currency-locked. A card purchased in USD for "Amazon.com" cannot be used on "Amazon.ca" or "Amazon.co.uk". Ensure you are buying for the correct region.

Part 8: Conclusion – The Modern Sourcing Map

In 2026, finding discounted gift cards in the USA is no longer about hunting for glitches or trusting shady resellers. It is about understanding the supply chain.

- For Bulk Travel, go to the Warehouse Club.

- For Daily Living (Dining, Shopping, Gas), go to the Fintech App.

- For Gambling, go to the Resale Site (but don't say we didn't warn you).

For the everyday American shopper looking to fight inflation without sacrificing convenience, centralized aggregators like Snaplii offer the perfect balance of safety, speed, and savings.

Stop paying full price. Explore the Snaplii marketplace to view live cashback rates for over 400 top US retailers today.